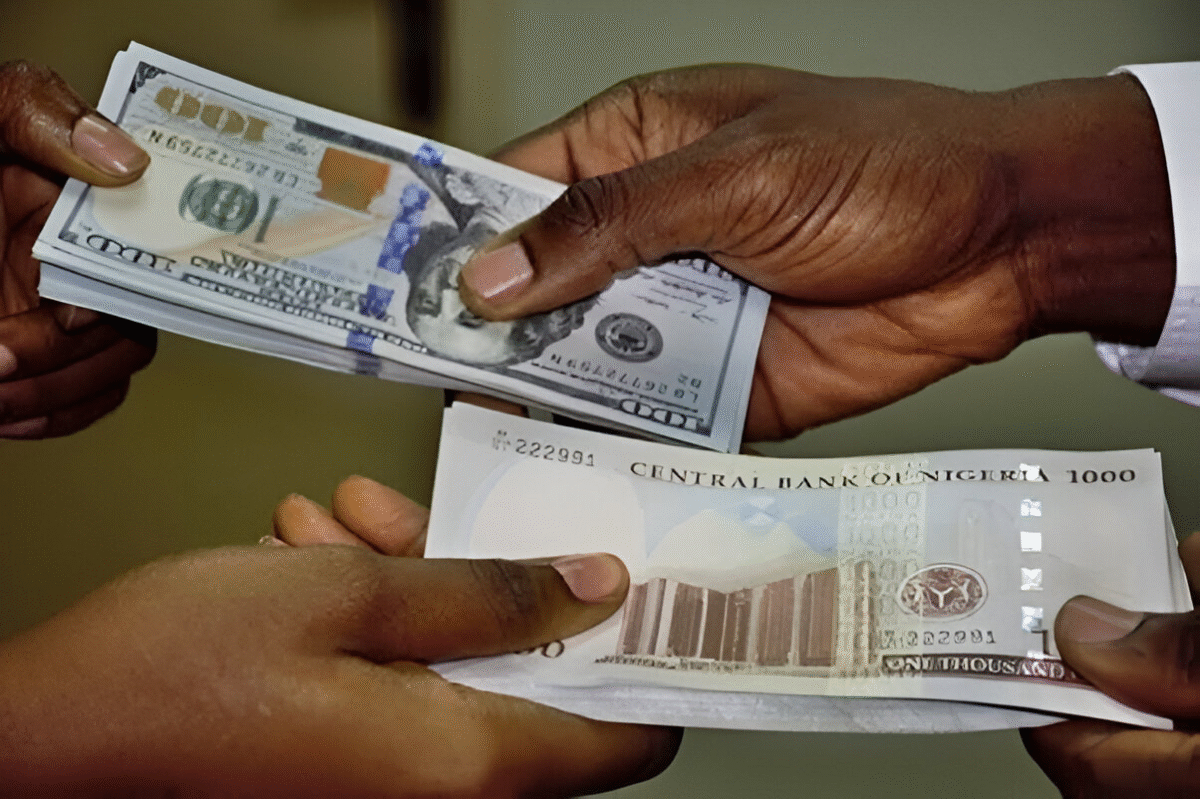

Tag: Nigeria Naira

Dollar Exchanges For N1,515 at Black Market

Naira Rises To N1,495/$ In Parallel Market

The Naira strengthened in the parallel market yesterday, appreciating to ₦1,495 per dollar from ₦1,500 per dollar recorded on Monday.

But the Naira depreciated to N1,464.5 per dollar in the Nigerian Foreign Exchange Market (NFEM).

Data published by the Central Bank of Nigeria, CBN, showed that the exchange rate for the naira rose to N1,464.5 per dollar from N1,464 per dollar on Monday, indicating 50 kobo depreciation for the naira.

Consequently, the margin between the parallel market and NFEM rate narrowed to N35.5 per dollar from N36 per dollar on Monday.

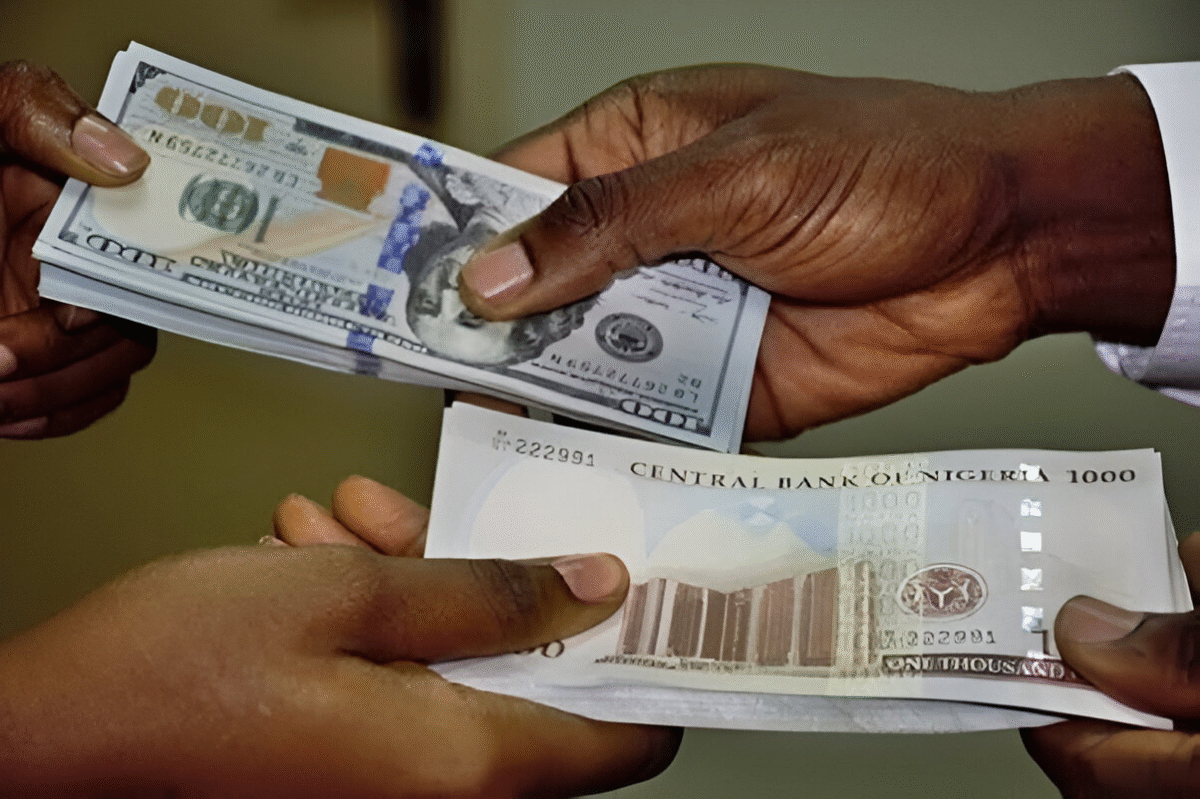

The International Monetary Fund (IMF) said yesterday that the Naira’s depreciation should not automatically be seen as a negative occurrence.

The Financial Counsellor and Director of Monetary and Capital Markets of the Fund, Mr. Tobias Adrian, stated this while fielding questions at the Global Fiscal Sustainability Report press briefing at the ongoing Annual Meetings of the World Bank and the IMF in Washington DC, USA.

Asked what policy measures the Fund would advise the Nigerian to adopt to shore up the value of the Naira that has suffered a major devaluation in the last two years, the Director said, “In terms of the Nigerian economy, of course, you know exchange rates are important, are important buffers to adjust the domestic economy relative to shocks.

”So, you know, a depreciating exchange rate is not necessarily a bad thing. It may actually be a good thing to restore equilibrium.

“And we have indeed seen in Nigeria, you know, many steps to strengthen policy frameworks, such as on the monetary policy side. And you know, we generally do recommend moving towards more flexible exchange rates.

“And yeah, in addition to monetary policy actions, revenue collection has strengthened in Nigeria, and transparency in terms of FX reserve positions have improved.

”I think all of this has contributed to lower inflation from more than 30% last year to 23% this year, as well as improved FX reserve positions in Nigeria.

”So the direction of travel appears to be positive.”

Mr. Adrian noted however, that Sub-Saharan Africa in general was facing and continue to face headwinds.

He said, “While growth has been pretty strong during this period where financial conditions are easy, capital flows are resuming, it is also possible that the previous capital flow surge and then retracement cycles that we have seen before could happen, and when that happens, it would expose some of these economies with vulnerabilities, particularly when foreign investments were to retrace.

”So, it is important for countries to continue to improve the fundamentals on the fiscal and monetary policy side, but also in terms of developing more structural policies like revenue mobilization, as Nigeria is trying to do- debt management and hopefully also support from the international community.”

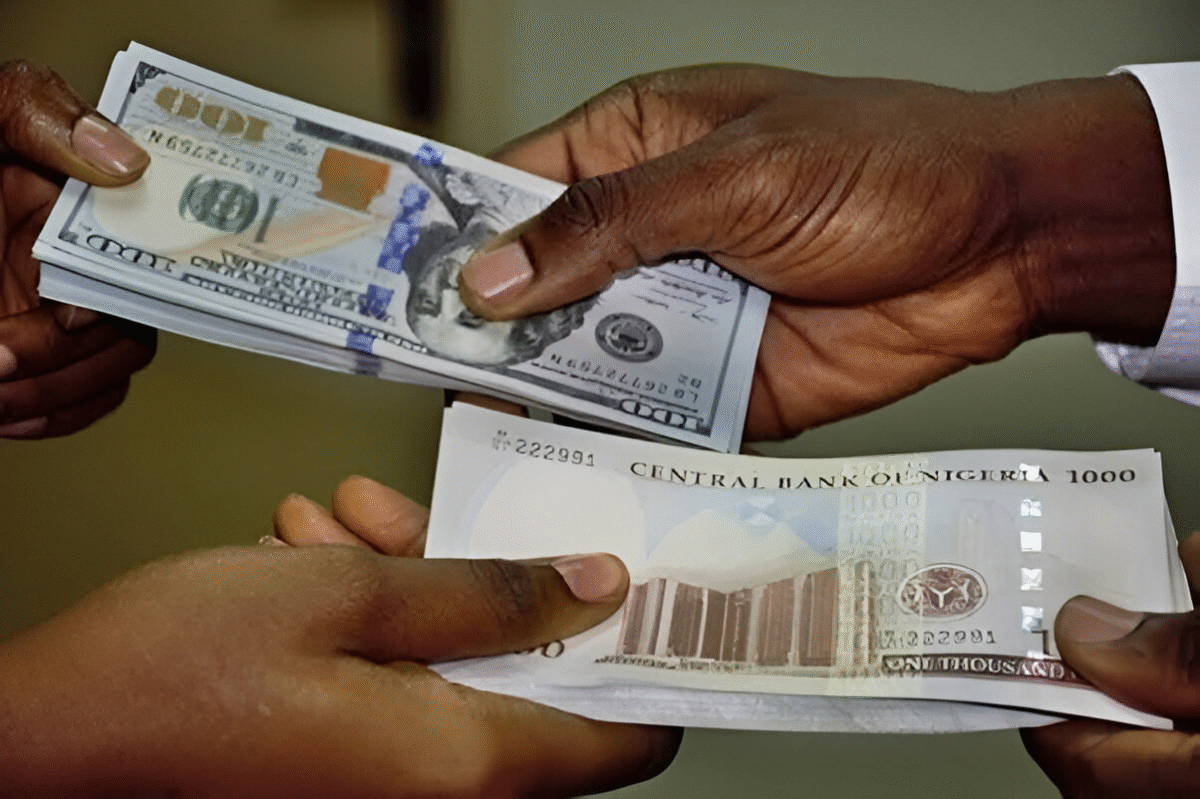

The Naira has depreciated against the United States Dollar on Monday.

The Naira appreciated on the official foreign exchange market, closing at ₦1,455.23 per dollar — a 1.36% gain from the ₦1,475.34 recorded on September 30.

This is the first time since May 2024 that the exchange rate has dipped into the ₦1,400 range, highlighting the currency’s strongest performance so far this year.

The Central Bank of Nigeria’s (CBN) adoption of the electronic foreign exchange matching system (EFEMS) in December 2024 has played a key role in this improvement.

When EFEMS was launched, the naira was trading at ₦1,660 per dollar on the official market, making the current rate a significant gain.

In the parallel market, the naira also appreciated, closing at ₦1,480 per dollar compared to ₦1,485 at the end of September. This marks the best parallel market rate recorded this year.

President Bola Tinubu, in his Independence Day address on October 1, highlighted the currency’s regained stability after a turbulent period in 2023 and 2024.

He noted, “The naira has stabilised from the turbulence and volatility witnessed in 2023 and 2024. The gap between the official rate and the unofficial market has reduced substantially, following FX reforms and fresh capital and remittance inflows.”

Adding to the optimism, Abdul Samad Rabiu, chairman of BUA Group, forecasted on September 25 that the naira could strengthen further to between ₦1,300 and ₦1,400 per dollar by the end of the year.

The Naira strengthened in the parallel market yesterday, rising to N1,530 per dollar from Wednesday’s rate of N1,537 per dollar.

Likewise the Naira appreciated to N1,490 per dollar in the Nigerian Foreign Exchange Market (NFEM).

Data published by the Central Bank of Nigeria, CBN, showed that the exchange rate for the naira fell to N1,490 per dollar from N1,498 per dollar on Wednesday, indicating N8 appreciation for the naira.

Consequently, the margin between the parallel market and NFEM rate widened to N40 per dollar from N39 per dollar on Wednesday.

Naira Slides To N1,550/$ In Parallel Market

The Naira weakened further on Tuesday, August 26, closing at N1,550 per dollar in the parallel market, compared to N1,540 per dollar on Monday.

In the Nigerian Foreign Exchange Market (NFEM), the local currency also weakened slightly to N1,537 per dollar, compared to N1,536.99 per dollar the previous day, according to data from the Central Bank of Nigeria (CBN).

This depreciation widened the gap between the official and parallel market rates to N13 per dollar, a sharp increase from N3.01 recorded on Monday.

The currency’s drop reflects sustained pressure from high demand for foreign exchange amid limited dollar supply, a challenge that has persisted despite ongoing CBN interventions and recent policy reforms aimed at stabilizing the market.

Analysts warn that without a significant boost in forex inflows and improved investor confidence, the Naira could face further volatility in the coming weeks.