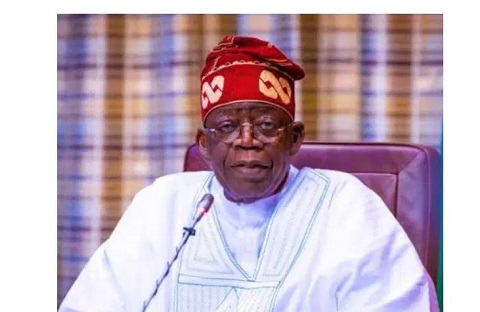

The World Bank has given a verdict on President Bola Tinubu’s economic reforms.

According to the World Bank, despite the expansion of the Nigeria’s economy and the revenue increase, poverty rate remains alarmingly high.

The Bretton Woods institution declared that 139 million Nigerians are living in poverty in 2025 despite the economic reforms embarked upon by President Bola Ahmed Tinubu.

Country Director, World Bank Nigeria, Mathew Verghis, spoke in Abuja at the launch of the Nigerian Development Update where the bank also projected that Nigeria’s economy would grow by 4.4 per cent in 2027.

The World Bank’s verdict is coming a few weeks after Tinubu praised his government for the economic rebound being witnessed in the country.

Tinubu had declared that Nigeria has “turned the corner” on its economic and social challenges, assuring citizens that the sacrifices of the past two years were beginning to yield measurable results.

During a live nationwide broadcast to commemorate Nigeria’s 65th Independence anniversary, Tinubu stressed that his administration’s reforms were already repositioning the country on the path of stability, growth and self-sufficiency.

“I am pleased to report that we have finally turned the corner. The worst is over. Yesterday’s pains are giving way to relief. I salute your endurance, support and understanding,” the president said. “I will continue to work for you and justify the confidence you reposed in me to steer the ship of our nation to a safe harbour.”

The removal of subsidy from premium motor spirit (PMS), otherwise known as petroleum, has freed more revenues to the coffers of the federal government with states also getting more allocations.

The monetary policy reforms have also seen the foreign reserves rising to over $43 billion; while the exchange rate market has stabilised. Inflation eased for the fifth consecutive month to 20.12 per cent in August.

But the World Bank’s Country Director said:“So, these results are exactly what you need to see in a stabilisation. These are big achievements. However, despite these stabilisation gains, many Nigerians are still struggling. Most households are struggling with eroded purchasing power.

“In 2025, we estimate that 139 million Nigerians live in poverty. So, the challenge is clear: how to translate the gains from the stabilisation reforms into better living standards for all.”

He stated that the federal government must reduce inflation, particularly food inflation, ensure effective use of public funds and expand safety nets, to address the high rate of poverty in the country and ensure that citizens enjoy the gains of reforms.

“Food inflation affects everybody but particularly the poor and has the potential to undermine political support for the reforms. Use public resources more effectively ensuring that spending drives real development results that benefit people and three, expanding the safety net so that the poorest and vulnerable get support,” he added.

The World Bank projected that Nigeria’s economy would grow by 4.4 per cent in 2027, compared to the 4.2 per cent earlier projected for the year 2025.

It explained that the growth would be driven by services and supported by agriculture and non-oil industry.

Samer Matta, the World Bank’s Senior Economist for Nigeria, in a presentation titled, ‘From Policy to People: Bringing the Reform Gains Home’, said inflation is expected to gradually ease but remain elevated, requiring sustained monetary discipline and structural reforms to tackle food prices, the “biggest tax on the poor”.

The senior economist noted that the outlook for Nigeria’s economy remains cautiously optimistic.

According to the NDU, Nigeria’s economy expanded by 3.9 per cent year-on-year in the first half of 2025, up from 3.5 per cent in the same period of 2024.

“Growth was driven by strong performance in services and non-oil industries, alongside improvements in oil production and agriculture.

“The country’s external position has strengthened, with foreign reserves exceeding $42 billion and the current account surplus rising to 6.1% of GDP, supported by higher non-oil exports and lower oil imports.

“On the fiscal side, despite lower oil prices, the federal deficit is projected at 2.6% of GDP in 2025, broadly unchanged from 2024, while public debt is expected to decline for the first time in over a decade — from 42.9% to 39.8% of GDP,” the report said.

It cautioned that the macroeconomic gains had yet to translate into tangible improvements in people’s lives, adding that many households continued to face hardship, with poverty and food insecurity remaining high.

The NDU noted that Nigeria’s poor households, who spend up to 70 per cent of their income on food, have seen the cost of a basic food basket rise fivefold between 2019 and 2024, highlighting the need for continued efforts to reduce inflation and support the vulnerable.