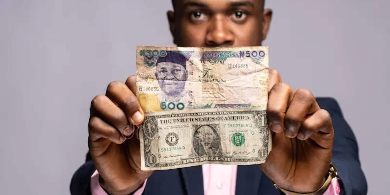

The Central Bank of Nigeria (CBN) has confirmed that only 82 Bureau De Change (BDC) operators currently have valid licenses to operate in the country.

The disclosure was made in a statement issued on Monday by the Bank’s spokesperson, Hakama Sidi Ali.

According to the apex bank, the approvals were granted in line with its powers under the Bank and Other Financial Institutions Act (BOFIA) 2020 and the 2024 Regulatory and Supervisory Guidelines for Bureaux De Change Operations.

The CBN said the final licenses became effective on November 27, 2025, warning that any individual or company operating a BDC without a valid license is in violation of Section 57 of BOFIA 2020.

“By this notice, only Bureaux De Change listed on the Bank’s website are authorized to operate from the effective date,” the statement said.

While noting that the list of licensed operators will be updated regularly on its website, the CBN urged the public to avoid dealing with unlicensed foreign exchange dealers.

“For the avoidance of doubt, operating a Bureau De Change business without a valid license is a punishable offense under Section 57(1) of BOFIA 2020. Members of the public are hereby advised to note and be guided accordingly,” the Bank added.

Full list of Licensed BDCs:

TIER 1

1 DULA GLOBAL BDC LTD

2 TRURATE GLOBAL BDC LTD

TIER 2

1 ABBUFX BDC LTD

2 ACHA GLOBAL BDC LTD

3 ARCTANGENT SWIFT BDC LTD

4 ASCENDANT BDC LTD

5 BARACAI BDC LTD

6 BERGPOINT BDC LTD

7 BRAVO MODEL BDC LTD

8 BRIMESTONE BDC LTD

9 BROWNSTON BDC LTD

10 BUZZWALLET BDC LTD

11 CASHCODE BDC LTD

12 CHATTERED BDC LTD

13 CHRONICLES BDC LTD

14 COOL FOREX BDC LTD

15 CORPORATE EXCHANGE BDC LTD

16 COURTESY CURRENCY BDC LTD

17 DANYARO BDC LTD

18 DASHAD BDC LTD

19 DEVAL BDC LTD

20 DFS BDC LTD

21 EASY CASH BDC LTD

22 ELELEM BDC LTD

23 E-LIOYDS BDC LTD

24 ELOGOZ BDC LTD

25 ENOUF BDC LTD

26 EVER JOJ GOLD BDC LTD

27 EXCEL RIJIYA FOREX BDC LTD

28 FABFOREX BDC LTD

29 FELLOM BDC LTD

30 FINE BDC LTD

31 FOMAT BDC LTD

32 GENELO BDC LTD

33 GENTLE BREEZE BDC LTD

34 GRACEFUL GLORY AND HUMILITY BDC LTD

35 GREENGATE BDC LTD

36 GREENVAULT BDC LTD

37 HAZON CAPITAL BDC LTD

38 HIGH-POINT BDC LTD

39 I & I EXCHANGE BDC LTD

40 IBN MARYAM BDC LTD

41 JOURNEY WELL BDC LTD

42 KEEPERS BDC LTD

43 KHADHOUSE SOLUTIONS BDC LTD

44 KIMMELFX BDC LTD

45 KINGSOFT ATLANTIC BDC LTD

46 M.S. ALHERI BDC LTD

47 MASTERS BDC LTD

48 MCMENA BDC LTD

49 MKOO BDC LTD

50 MKS BDC LTD

51 MR J GOLF BDC LTD

52 MUSDIQ BDC LTD

53 MZ FOREX BDC LTD

54 NEJJ BDC LTD LTD

55 NETVALUE BDC LTD

56 NEW WAVE BDC LTD

57 NOTABLE AND KINGSTON BDC LTD

58 PILCROW BDC LTD

59 RAPID BDC LTD

60 RIGHTWAY BDC LTD

61 RWANDA BDC LTD

62 SABLES BDC LTD

63 SAFETRANZ BDC LTD

64 SAMFIK BDC LTD

65 SEVENLOCKS BDC LTD

66 SHAPEARL BDC LTD

67 SIMTEX BDC LTD

68 SOLID WHITE BDC LTD

69 ST. NICHOLAS GLOBAL BDC LTD

70 TOPFIRST UNIQUE MULTICHOICE BDC LTD

71 TOPGATE BDC LTD

72 TRAVELLER’S CHOICE BDC LTD

73 TUCA GLOBAL BDC LTD

74 TURBOVA BDC LTD

75 TURN-UP BDC LTD

76 UNIGO BDC LTD

77 VICTORY AHEAD BDC LTD

78 WHITEWAY WWW BDC LTD

79 YUND GLOBAL LINK BDC LTD

80 ZAMAD FOREX BDC LTD